Succeeding as a Management Consultant by Kris Safarova

Rating: 8/10

The book takes the reader through a Strategy and Operations Management consulting case study explaining key steps of the engagement and the tools used at each step. The narrative follows the format of a story about an assignment at Goldy, a large mining corporation in Brazil. The story introduces key concepts such as building a financial model, developing a storyboard, building an issue tree, managing stakeholders, defining the workstream charter, etc.

This summary will cover the core steps of a consulting engagement and the key tools discussed in the book, but will omit the many additional best practices, template examples, and other advices also covered. These include discussion of consulting ethics, stakeholder management, communicating change, and service strategy just to name a few.

Memorable quotes

Unless you have left money on the table without hesitation, you probably have never lived by your values or your values are inappropriate.

The responsible person does what they are told, correctly. The accountable person thinks about why they are completing task x, determines if another task should be done to achieve the intended goal and makes those changes. They own the problem and not the solution. People who own the problem work harder, face tougher hurdles and are sometimes seen as arrogant, but they get the job done and ultimately are more successful.

Productivity is measured as the output value / input. There is no other definition of productivity. It is erroneous to assume productivity is how fast one completes a task, or the number of tasks completed in a year. Completing a task quickly that is of little value or completing many tasks that add little value will actually lower productivity. Completing just one task over an entire year that is very valuable means one is actually very productive. Understanding productivity is important. It will change your life if you manage your schedule by this definition.

Introduction

The typical management consulting engagement is conducted over a period of 8 weeks. This is often extended by one week for preparations before the team goes on site.

- Week 0: Preparations, developing the problem statement, the decision tree, and hypotheses for the prioritized options.

- Week 1: Focus interviews to build trust with the client and to validate week 0 assumptions.

- Week 2-4: Financial analysis, benchmarks, case studies to identify the size of the benefits.

- Week 5-6: Find data to test hypotheses, list quick wins and options to solve the problem, calculate the benefits.

- Week 7-8: Prepare implementation plan.

Preparations

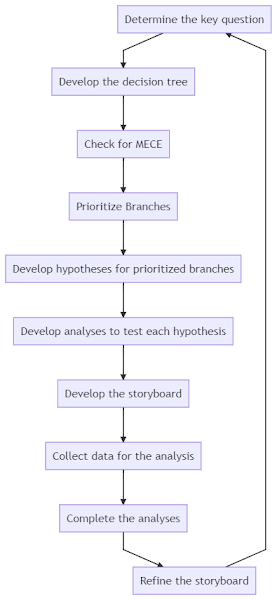

It may seem counter-intuitive, but consultants typically use week 0 (before arriving on site) of an engagement to research the issues faced by the client and to develop working hypotheses for the issues and solutions. This is then used to identify the key question to be answered during the engagement. To answer the key question, it is split into sub questions following the MECE (see more on this later) principle. The solution hypotheses are tested and refined during the engagement. Consultants must maintain a fine balance between keeping an open mind and driving to a preconceived result regardless of the facts.

Beyond the identification of the key question and the solution hypotheses, this preparation week also serves to build foundational understanding of the client's business, especially when consultants lack experience with the client or the industry.

The preparation allows the team to see the overall message and to focus their work before the engagement begins. Preparation involves the following activities.

Step 1: Background research

Background research involves reading background material provided by the client as well as newspaper articles, analyst reviews, information on competitors, etc. Objective of this research is to gain a broad understanding of the issues without going into too much detail.Step 2: Identification of issues

During background research each team member writes down issues they think affect the client. The objective is not to be precise, but to brainstorm on a broad set of issues that may need to be addressed. Issues are later captured during meetings on post-it notes and placed on a whiteboard in the war room.

The war room is a conference room that only the engagement team has access to and which serves as the information hub for the consultants with key information, schedule, findings, etc. displayed around the walls. Confidentiality is a key concern, which if handled poorly can seriously damage or jeopardize the engagement and the client relationship. When not used, the war room door is kept locked.

Step 3: Grouping issues into themes

Once issues have been captured, in subsequent meetings, the team will debate and group issues into themes. Typically there should be no more than 8 themes identified.

Step 4: Identifying the key question

Through further meetings the team debates key themes and questions. The team then takes the key question posed by the client and tests if it is indeed the question they need to answer.

If we solved this question posed by the client, would the problems at the client be resolved?

Perfectly answering the wrong question will not help the client. If the team disagrees with the question posed by the client, an alternative key question is developed. The new key question along with the arguments why this question is more relevant will be aligned with the client at the earliest next opportunity.

Step 5: Breaking down the key question into a decision tree following a MECE approach

To answer the key question, it is split into smaller questions that are Mutually Exclusive and Collectively Exhaustive (MECE). Questions may be split to 3-4 layers of sub-questions following the MECE principle all the way. Following this approach is particularly important for building the business case model used to analyze hypotheses. Not applying MECE would result in the risk of double counting and leaving gaps in the financial model.

- Mutually Exclusive: Have the questions been sufficiently separated so that changing the variables that impact the question will have NO impact on another question?

- Collectively Exhaustive: Are these the complete list of questions in this layer that can impact the previous question?

Step 6: Prioritizing the branches of the decision tree

By placing the "issue" post-its (#) on the decision tree, the clustering of post-its under certain questions helps visually identifying priority branches.

Step 7: Developing hypotheses for the prioritized branches

The top 3 to 5 branches are assigned to owners within the team. The MECE approach taken when building the decision tree is key to the team's ability to split the analysis work. While owners work on their assigned part, it is also critical to the success of the engagement to share information and collectively debate findings.

The team thus develops hypotheses explaining why the problem is occurring or what can be done to fix the problem. This process for developing hypotheses ensures hypotheses are also MECE and specific to the client's problem.

Using the detailed decision tree and hypotheses, the team can determine the likely answer to the questions before arriving at the client site.

Step 8: Developing analyses to test each hypothesis

An independent business case (BC) model is developed that will be used to verify the solution and improvement opportunities. Through the model the engagement team must ask questions such as the following:

- Are the opportunities mutually exclusive? In other words, are we double counting benefits?

- Does this opportunity make sense? Will it actually work as described?

- What is the impact of doing this?

- Is this opportunity worth pursuing? What are the returns and cash flow patterns?

Step 9: Developing the draft storyboard

The storyboard is developed based on the decision tree and summarizes the expected findings of the engagement. The team will only write out the headlines so that everyone can understand what message they expect to deliver based on their expectations of the data analysis. Although the storyboard may change as the analyses are conducted, the initial thinking of the team will be sufficient to guide the engagement.

The storyboard is essentially a list of likely findings from testing each hypothesis. The flow of findings on the storyboard should follow the chosen communication approach. I will not cover in this summary the Deficit Model and Aspirational Model explained in the book (page 276).

High level structure of a strategy and operations study

Strategy and operations studies have the following general structure: scoping, focus interviews, benchmarks, case studies, financial analysis (ratio analysis, cost structure analysis, DuPont analysis, and capital effectiveness analysis), top-down business case, opportunity charts, financial or economic modelling, bottom-up business case.

Strategic scoping of the study

- What is the problem statement?

- What are the goals and metrics to fix the problem?

- What are the economic boundaries of this business? Are they changing?

- How is value created in this business? Is the model changing?

Focus Interviews

Focus interviews are a key tool that should be deployed on every engagement as they rarely identify wrong themes to be analyzed. Additional benefits of focus interviews include the following.

Focus interviews are a safe way for the team to learn about the client and industry while building relationships. It also forces them to reconcile their largely theoretical understanding of the problem with the practical considerations.

The process of developing the interview questions forces the team to think about whether or not they have the correct hypotheses, and how they could collect the data to test them. The design of the questions also explicitly forces the team to go broader than their hypotheses to determine if other issues exist. A good way to seek insight is to ask the interviewee to draw the key steps of the value chain and provide feedback about each step, including comments regarding performance compared to other steps in the process as well as compared to peers.

In case there is tension between employees and management, a situation may develop in which employees only trust consultants with their issues, and management sees consultants as the source of unfiltered feedback. Thus consultants are able to build trust with both parties.

Very early in the study, an update must be presented to senior management. Building credibility is the top goal of this first update. From a credibility perspective, it is very difficult for the management team to dispute findings from focus interviews, benchmarks, and financial ratio analyses.

Benchmarks

Consulting firms have the additional opportunity to conduct internal benchmarks between clients within the same industry. For this to work calculations must be uniform and consistent, which in turn means having the methodology properly documented and teaching consultants to access this methodology/data versus pulling information from an unknown source that was prepared following an unknown method.

Case studies

Case studies help understand how a problem evolved at another company and help clients visualize what did and could happen to them. They are both a visioning and a planning tool, but they are not a template of best practices to be copied since no two companies are the same.

Case studies can be abused, and any case study can be designed to show anything the consultants wants to show. Consultants cherry-pick both the case studies to present but also the facts within that case study. Case studies may be used to support a pre-existing, but as yet, untested hypothesis or to expose the consultant and client to a new view that disputes their hypothesis. Resist the temptation to only pick case studies that support your own or your client's preconceived view.

Cases studies must have very narrow scope for them to be meaningful, since under normal circumstances it would take months to fully understand a company and interpret what is happening. A broad case study by nature can only be superficial and therefore misleading.

A period case study providing an interpretation of a company's performance over a period of years is much harder to do then about current events. This is because there will be many strong opinions about the past, while current events are still to be evaluated.

Unless the consultant was involved with the company that is the subject of the case study, the case study will have limited credibility. It is good practice to have someone in the room who had been involved in the company being case-studied.

Analyses

Four type of analyses are performed in the story presented in the book: financial analysis, financial or economic modelling, bottom-up business case, and top-down business case.

|

Type

|

Objective

|

Analysis

|

| Financial Analysis |

What is going on in this company?

|

Financial reporting

Ratio analysis Breakdown of ROCE Stakeholder value calculation Simple sensitivity analysis |

|

Financial/Economic Modelling

|

What could potentially happen to this company?

|

Linked sensitivity analysis

Valuation modelling Scenario modelling Optimization analysis |

|

Top-Down Business Case

|

What are the challenges and associated costs?

|

Benchmarking exercise Gap analyses

P&L and balance sheet impact estimation Cash flow NPV modelling Return on investment calculation |

|

Bottom-Up Benefits Case

|

What level of benefits do we commit to achieve?

|

Opportunity charts

Opportunity selection and prioritization |

Financial Analyses

Top-down financial analyses are hard to dispute because analyses are not interpreting much. They are simply examining numbers from the clients' own accounts and presenting them in a new way. They operate like a slightly more sophisticated version of a dashboard warning light. It tells the team and client where a problem may exist and provides a little more information.

Ratio analyses

Basic calculation of simple profitability, cash flow, and simple balance sheet ratios. For example, a profit problem would show up in the net income figure at the corporate level or business unit level. No need to be detailed.

According to

Investopedia

- Ratio analysis compares line-item data from a company's financial statements to reveal insights regarding profitability, liquidity, operational efficiency, and solvency.

- Ratio analysis can mark how a company is performing over time, while comparing a company to another within the same industry or sector.

- While ratios offer useful insight into a company, they should be paired with other metrics, to obtain a broader picture of a company's financial health.

Cost structure analyses

These require fairly simple analysis of margins, fixed costs, variable costs, contribution margins, and / or break-even points. The benefit is in understanding how the business should be run given the cost structure sought by the client, and how it is actually run. A cost structure analysis can highlight for example high variable cost of manual activity preventing growth unless a once-off high fixed automation cost is implemented.

The cost structure of a firm describes the proportion of fixed and variable costs to total costs. Operating leverage refers to the level of fixed costs within an organization. The term “high operating leverage” is used to describe companies with relatively high fixed costs. Firms with high operating leverage tend to profit more from increasing sales, and lose more from decreasing sales than a similar firm with low operating leverage. saylordotorg.github.io

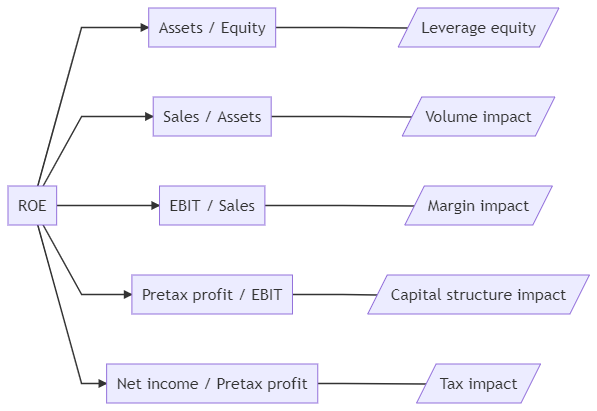

DuPont / ROCE analyses

Is the client earning a healthy return for their capital deployed? If not, where are the problems and why is it likely happening? Does the client want to be in a business that destroys so much capital?

A DuPont analysis is used to evaluate the component parts of a company's return on equity (ROE). This allows an investor to determine what financial activities are contributing the most to the changes in ROE. An investor can use analysis like this to compare the operational efficiency of two similar firms.

If the ROE either increases due to increase in operating efficiency or improved asset utilization, it is a good sign for investors.

If ROE increases on account of financial leverage, it would imply that the profit is due to the financial strategy of the company rather than good operations of it.

ROCE: Return on Capital Employed is a financial ratio that determines a company's profitability and the efficiency the capital is applied. If not, the company is less productive and inadequately building shareholder value.

Financial/Economic modelling

Every economic model has a core calculation engine that produces the data around which all the calculations will be performed.

The core engine, sometimes called an activity model, itself must be driven by a set of primary data. The model determines how key metrics (such as ROCE) change as the primary data is altered.

Built around the core engine, the model will have several options that must be tested. An option is a different route for management to fix the business. The model should be able to test all the options that have a significant impact on production value.

The model must be explicit about what will be assumed, what will be measured and included, and what is simply taken from industry benchmarks.

The amount of variability / flexibility in the model is determined by the options to be tested; the economic environment to be simulated; insights the team wants to extract from the model; and other analyses the team need to run.

The output of the model is just as important as the input. What metrics and measures should the model generate?

The economic model must be simple and specifically answer the questions to be answered.

Top-Down and Bottom-Up models

Top-down analyses are based on benchmarked data, financial analyses and case studies developed at a higher level with little detailed analysis. These indicate "what is possible" but do not explain how it can be achieved.

The bottom-up analysis focuses almost entirely on "how it can be achieved". Yet, it is not exhaustive in nature. Many of the bottom-up analyses will need to be verified during the implementation.

At the end of the engagement both have to reconcile.

Value Tree

A central part of building business cases and economic models is the value tree. The value tree takes the value creation metric and breaks it down into its constituent parts.

Below is a sample value tree from the book.

Model Architecture

The model architecture is somewhat similar to early design mock-ups produced by architectural firms to demonstrate concepts to a client.

The model architecture has its own "charter" defining the purpose of the model. This outlines the metrics to be calculated, defines the part of the business to be analyzed, must produce the business case for each option, plus a list of additional questions the model should answer such as expected returns, cashflows, payback, etc. (page 172)

Opportunity charts

The initial questions on the opportunity chart focus on what is not working or what could be improved. The opportunity is then described with a separate field reserved for specifying what must be changed. Baseline measures are requested articulated as lagging KPIs that measure the process currently. Success is defined as lagging and leading KPIs. The second part of the template details out the benefit KPI so it can be incorporated into the Business Case. (page 264)

Impact on client financials

- Revenue enhancement

- Cost reduction

- Cost avoidance

- Capital reduction

- Capital avoidance

Closing

- Hold yourself to the highest professional standards.

- We don't sell consultancy, profit is not a goal, but a consequence of honoring the clients.

- Serving the best interest of the client is not equal to making them happy.

- Invest in others graciously.

- You always have the right to dissent, to voice your disagreement.

- There is no hierarchy, you have equal access to everyone in the firm (i.e. consulting partners, analysts, etc.).

- Fancy analysis is important, but most valuable insight often comes from front-line employees.

- Never stop learning.

I'm genuinely impressed with your knowledge. You have such great knowledge of dressing. Please share more information like this. I really appreciate your blog. Thank you for sharing this. Organizational change management strategies

ReplyDelete